Radar: Edgeware

This Formal Verification crypto research is free for everyone. If you don’t want to miss out on the latest crypto research and content, then hit that subscribe button today.

Edgeware

While the interest in layer 1 protocols intensifies, Edgeware - a smart contract platform built on Parity’s substrate - is receiving somewhat less attention. But there are some key developments behind the scenes that are worth paying attention to as we itch ever closer to the launch of Polkadot mainnet. So let’s cover the key developments.

For those unfamiliar with the project, Edgeware is a smart contract platform developed by Commonwealth Labs that aims to have a completely self-governing structure using on-chain governance processes, including identity, council, and treasury modules. Edgeware adopts a nominated proof-of-stake consensus mechanism (NPoS), building upon other self-governance models such as Tezos. Holders of Edgeware’s native token EDG are given voting and staking rights and the token is also used to pay for any state changes in the Wasm smart contract module.

Edgeware was launched via a lockdrop - a novel alternative to a standard airdrop. From June to August 2019, ETH holders had the option to lock their assets for either 3, 6, or 12 months. Users could also ‘signal’ their ETH but were awarded much less EDG. The lockdrop was a success with a total of 2.9k addresses locking 1.19m ETH (over 1% of supply) and 1.9k addresses signalling 4.3 ETH.

So what’s happened since? A total of 85 validators are actively securing the chain with Edgeward’s first ever governance approval action assigning Commonwealth Lab’s Thom Ivy as an ID registrar (see here for info on Edgeware’s identity module).

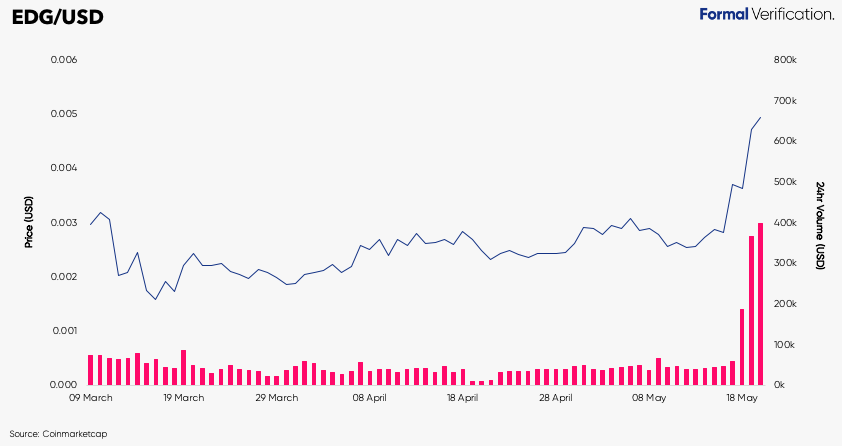

But in the last few days, EDG is up over 80% with a large majority of the volume stemming from Singapore exchange, MXC (liquidity is still fairly low). While there is no corresponding surge in on-chain activity for Edgeware, there are 2 possible reasons as to why we may start seeing momentum build behind Edgeware on the market:

1) Framework Ventures, early investors in Chainlink and Synthetix, announced in March they were backing Edgeware investing $500k into Commonwealth Labs.

In addition to this, Framework also locked 20k ETH in the lockdrop to help advance Edgeware’s distribution. Beyond deploying capital, Framework also seek to run validator nodes, run for council and build applications on top of the smart contract platform.

Framework Ventures have previously worked with projects, such as Kava and Futureswap, to re-structure their economics. In a similar vein, and with such a concentrated bet on Edgeware, Framework are likely to get their hands dirty ensuring the self-governing smart contract platform can effectively attract developer mindshare as Polkadot’s ecosystem builds out.

2) Edgeware will likely become a smart contract parachain on the Polkadot network which will be launching its mainnet soon.

With Edgeware being built with Parity’s substrate library, the intention was always to bring Edgeware’s smart contract functionality to the polkadot ecosystem by connecting it to other polkadot parachains through the Polkadot’s central relay chain. Importantly, once Polkadot launches its mainnet, the Edgeware community will have to vote to become a parachain. If the community approve, it is possible that the Web3 Foundation will sponsor Edgeware as a parachain if they deem it to be a ‘common-good chain’ instead of going through the standard auction process.

Critically, as Edgeware moves from being an independent chain to a Polkadot parachain, it will delegate its chain validation over to Polkadot’s relay chain pool. During Edgeware’s time as a parachain, EDG will no longer serve as a staking token on a purely validation sense. However, Edgeware’s token will still be used for on-chain activities, such as fees and governance. Far in the future, Edgeware might even become a full fledged parachain in which Edgeware would then provide security for parachains connected to it.

The competition for Polkadot smart contract platforms is already heating up. While Edgeware has much to prove in order to attract dApp developers, it will be fascinating to see how Edegeware evolves as both a potential smart contract parachain and as a novel self-governing network.

About Formal Verification

In collaboration with leading digital assets data companies, Formal Verification offers both key and concise data analysis and ecosystem research for decentralised networks so you can be attuned to the absolute key developments both on and off the chain.

Formal Verification will be free for everyone until June 8th. If you subscribe before June 8th, you’ll receive Formal Verification at a 20% discount forever as a special thank you for your early support. Get it locked in.

Formal Verification research is not investment advice and is strictly for informational purposes only. Conduct your own research.