In The Week

Developments from Balancer, 1inch, OMG, StarkWare, Polkadot

Only 3 days left - All Formal Verification research will be free for everyone until June 8th. If you subscribe before June 8th, you’ll continue to receive all research at a 20% discount forever as a special thank you for your early support. Free members will only get partial research posts. Get it locked in.

Spotlight 🔎

Balancer

Balancer’s liquidity mining goes live, with pools being eligible to receive Balancer’s new governance token, BAL.

Starting on the 1st June, liquidity providers contributing resources to the Balancer protocol are rewarded in Balancer’s governance token, BAL. BAL holders, who will represent the active participants (and thus direct stakeholders) of the network, will be granted voting rights in how the protocol evolves going forward. Each week 145k BAL will be awarded to users that contribute liquidity in Balancer pools.

The Formally Verified Take

Clearly, the BAL token mirrors the governance token design goals of other networks (e.g. Compound and Futureswap, with Kyber, Uniswap V2, pToken, as well as Curve all likely to implement similar governance structures soon). By applying this particular governance model, resource contributors are incentivised to participate in the early stages of a network’s growth - arguably at a point when it matters most.

Despite liquidity mining only going live just a few days ago, we are starting to see early signs of its effectiveness in attracting participation in the network. As of today, there have been 62 new Balancer pools created in June so far which already marks a 40% increase in the number of pools created in April and May. The number of new unique liquidity providers already contributing in June has already reached 223, a 70% increase from May’s numbers.

But there’s a discreet aspect to the distribution of BAL tokens that is also important to note not only because of how it aims to encourage trading against pools but also because of its potential implications for other networks competing for LP resources.

Firstly, let’s understand the BAL token distribution. The amount of BAL a pool receives is determined by both the USD value of the pool as well as the feeFactor. The addition of the feeFactor in the calculation will mean pools that have lower fees are given a heavier weighting, receiving a greater proportion of BAL tokens than those pools that have higher fees. The theory here is to grant pools that are encouraging network participation the most larger stakes in the network through the governance structure.

But the addition of liquidity mining might also pull the liquidity that is currently tied up in Uniswap. After all, there is a greater incentive to contribute as much liquidity as possible while overall liquidity is still being kickstarted. Are LPs willing to exit Uniswap and lower their fees if they start seeing value in supplying to Balancer pools early on instead? What makes this incredibly interesting is the potential for Uniswap to implement its own liquidity mining token in order to attract further its liquidity contributions as well as protect them.

Lastly, the addition of the BAL tokens may mean network stakers may be able to earn governing rights in a proof-of-liquidity model. In such a model, instead of reducing inherently liquidity by staking a network token for time t, users stake a Balancer LP token that represents their a particular number of the network’s native token. The implications of this is that network stakers can be simultaneously contributing to the liquidity of Balancer pools while also becoming governing members of Balancer.

Quick Takes ⚡️

1inch

Activity on DEX aggregator 1inch continues to grow in recent weeks facilitating $207 million in trading volume in the last 3 months.

1inch allows users to tap into different pockets of with splitting orders among multiple venues giving the best rates on the market with minimal slippage. The aggregator uses GasToken to potentially lower transaction fees for users when network congestion is high.

The Formally Verified Take

This growth is not only an indication to how users are preferring to exchange their assets in DeFi but also how users choose to capitalise on 1inch GasToken offering at a time of intense network usage. For context, Ethereum daily gas used stays high with the largest contributor to network congestion right now being Tether.

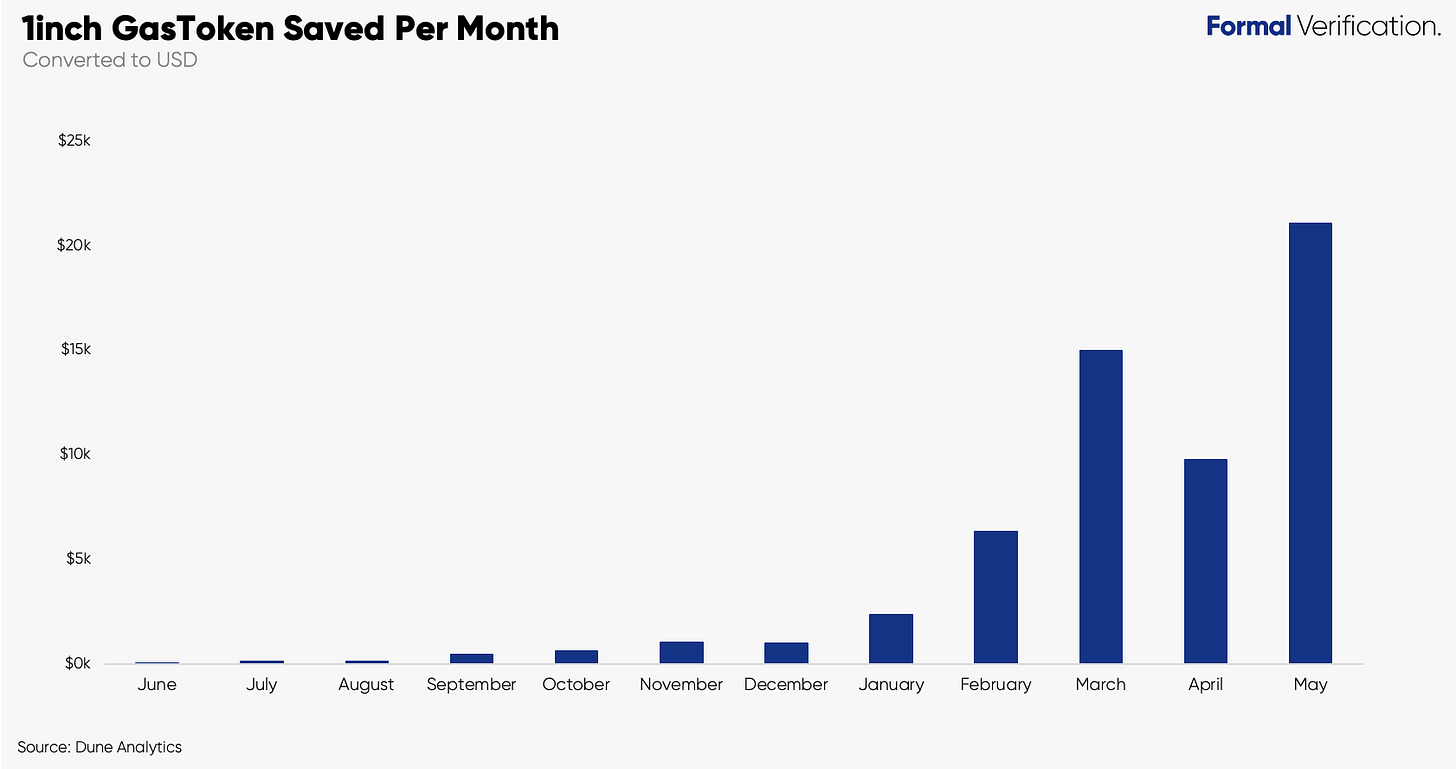

For each swap on 1inch, transaction fees are applied but can often work out ‘cheaper’ because users can buy and sell gas directly through tokenisation. This is facilitated by an Ethereum smart contract that stores gas when its cheap and uses it when it’s expensive. We can see that during recent high gas prices, the dollar value saved by the GasToken functionality has amounted to nearly $60k in value with nearly half coming from May alone. This is merely one example of how platforms can respond and adapt to environmental challenges - in this case, high gas price volatility.

OMG

OMG Network deploys Ethereum layer 2 scalability solution to mainnet.

OMG Network uses More Viable Plasma to increase the throughput capacity of Ethereum while simultaneously reducing transaction costs. Bitfinex has confirmed they will integrate Tether into the OMG Network as a way of reducing confirmation times enabling faster payments between users.

The Formally Verified Take

There have been a plethora of different proof-based attempts that attempt to improve on Ethereum’s layer 1 scaling. Specifically, being able to batch transactions off-chain and then submit proofs that represent new state changes through a succinct representation like a hash. OMG’s More Viable Plasma ultimately relies on fraud proofs. These form of proofs are provided as evidence that a state transition is incorrect, in other words, it is optimistically assumed that every state change is correct until proven otherwise (in contrast to validity proofs that present evidence that state transitions are correct - more on this in the next section).

One of the advantages of this approach is the lower requirement of computational resources and provides higher scalability. The drawback here is ensuring high consistent liveness of the parties claiming fraud. Moreover, as Plasma operators are able to be corrupted at any given point, exiting Plasma chains cannot be instantaneous (means exit games are required bringing further complexity). A problem might therefore arise for end users but in the coming months we will able to ascertain how attractive OMG is for Tether users and as a scaling solution generally.

StarkWare

StarkWare launches its first StarkEx engine for DeversiFi’s DEX.

StarkEx alpha marks the first commercial deployment of STARKs on the Ethereum mainnet and represents an alternative layer 2 scaling solution for self-custodial trading. Unlike fraud-proofs mentioned earlier, validity proofs do not rely on reporting illicit behaviour but instead prove that every state change is correct. It comes at a time when StarkWare announced the StarkDEX scalability engine alpha for non-custodial DEXs.

The Formally Verified Take

Historically, these validity proofs were too expensive but have now become cheaper and succinct in verification meaning they can now be used more practically. The StarkEx engine has been throughly battle tested with the StarkWare demonstrating the engine’s capabilities back in January this year - 9k self-custodial trades/second. With increased efficiency and high security assurances, it’s not unreasonable to think this will be a more fruitful avenue for future layer 2 scaling efforts compared to fraud proofs.

But its also important to dissect how it differs from other zk-Rollup solutions, such as the one underpinning the recently launched Loopring DEX. In the case of DeversiFi, a consortium of 7 members (see here for full list) keeps the off-chain data and if DeversiFi was to shut down, at least one of the 7 members must exist as well as be honest for users to get their assets back. In a zk-Rollup model, data is held on-chain and an Ethereum full node must exist to secure user funds. Additionally, costs for exchange operators on Loopring are determined by the how efficient transactions are batched.

Polkadot

The transition to Nominated Proof-of-Stake (NPoS) in Polkadot is soon approaching with 85 validators signalling their intent to validate once activated.

According to the Polkadot release schedule, NPoS will be activated once a sufficient number of well staked validators signal their intention to validate which is likely to be over 100 initially. With 85 validators and 47 nominations already signalled by DOT holders, it is likely the network will advance to the next phase fairly soon.

The Formally Verified Take

Unlike other PoS networks, Polkadot gives equal voting power to all elected validators its proportional justified representation model. NPoS is designed to discourage any concentration of validators. We’ve seen this somewhat play-out on Cosmos where the top 10 validators collectively have 46% of the network voting power although it is decreasing (in May 2019 it was higher at 57%). Here is where is gets rather interesting though. In Polkadot, a flat fee is given to validators regardless of how much staked is backing them (note - it may differ slightly from something known as Era points). This aspect of the model led Cryptium Labs to run 19 out of the 100 validators in the early stages of the Kusama testnet precisely because it was an economically rational strategy to execute.

This means the success of NPoS will be judged by its ability to nurture a pluralistic set of validators which naturally includes relying on the sound judgement of stake nominators. The important thing to realise here is that there is a separation of validation and political power in Polkadot. In any case, comparing validation diversification between Polkadot and other networks like Cosmos or Tezos will be an insightful watch.

Help Build Decentralised Networks 🌍

Consensys - Technical Lead

Chainlink - Cloud Reliability Engineer / Various

Brave - Security and Cryptography Engineer

Agoric - Product Manager

Set - Senior Back-End Engineer

dYdX - Senior Recruiter

NEAR - Security Engineer

Formal Verification Deal Sheet 🤝

Deals with become available on the 8th June for full Formal Verification members. 🙏

About Formal Verification

Formal Verification offers both key and concise data analysis and ecosystem research for decentralised networks and digital assets so you can be attuned to the absolute key developments both on and off the chain.

Hurry!

All Formal Verification research will be free for everyone until June 8th. If you subscribe before June 8th, you’ll continue to receive all research at a 20% discount forever as a special thank you for your early support. Free members will only get partial research posts. Only 3 days left - Get it locked in.