In The Network - Kyber

Volumes, BRRs, Fees

This Formal Verification research is free for everyone. Join the other Formal Verification members today and get full access to complete research and member-only bonus content.

Kyber

Kyber is an on-chain liquidity protocol on Ethereum that allows dApps, wallets, and end users access to competitive exchange rates for cryptoassets through a liquidity reserve model. Back in June this year, Formal Verification issued its first analysis of Kyber heading into the launch of the Katalyst. There, we explored Kyber’s market activity, KNC value composites, and the ‘market neutrality’ of KNC as an asset.

Since then, the KyberDAO has been live for 42 days and is already in its third epoch. We revisit the network in light of the new KyberDAO, analysing the latest trends in trading and DAO activity.

Volume

Kyber Network uses an open reserve model for its liquidity architecture which are ultimately managed by Kyber liquidity reserve managers. For every trade that occurs on the network, Kyber reserves are required to pay a small fee proportional to the trade size (currently set at 0.25%). Since the launch of Katalyst, KNC stakers in the KyberDAO are now able to choose how these network fees are distributed between burning, staking rewards, rebates. Therefore, volume is a core metric to monitor as it directs value to KNC as a cryptocapital asset.

The recent bullish market sentiment has been translated in higher trading volume for the network. Since the start of June, there have been 24 days where trading volume has surpassed $10m.

The ratio of price to volume as a composite metric can be useful to highlight periods of divergence between (value-driving specific) network activity and token price. In other words, we can identify when trading volume is increasing at a faster rate than the KNC/ETH price or decreasing at a slower rate than KNC/ETH price. Notably, the positive sentiment surrounding ETH combined with growing trading volume on Kyber has lead the ratio to be at near ATL for the past 12 months.

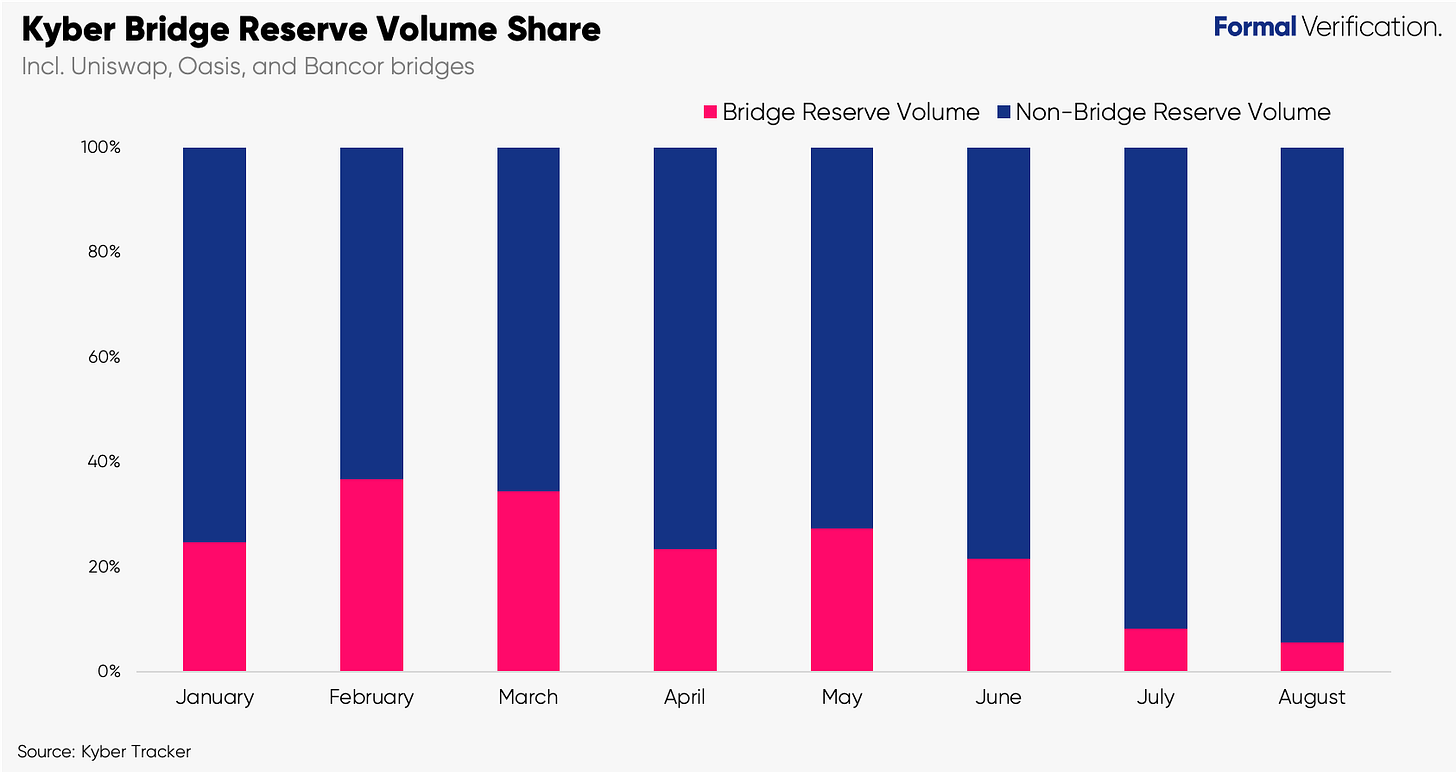

It is also important to see what portion of volume has contributed to network fees as not all trading activity is created equal for network stakeholders. This is due to the removal of fees from Bridge Reserves in late 2019. The reason for this was to ensure Kyber maintained a competitive edge within its niche even if it mean a reduction in network fees collected.

Positively, the proportion of volume facilitated by Bridge Reserves to total volume through Kyber has fallen to its lowest levels. This means that a large majority of the total volume is being captured by network fees which ultimately flow to KNC stakeholders.

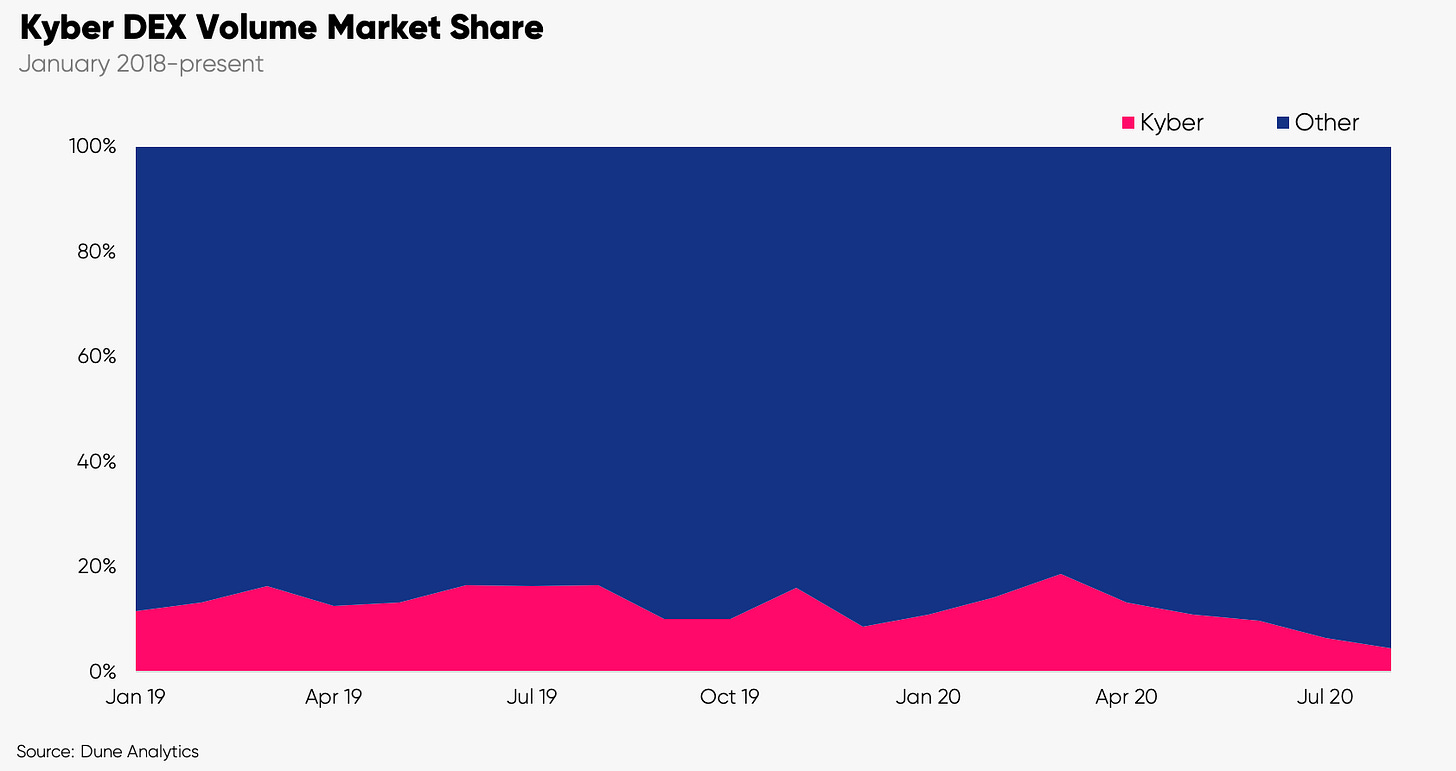

On the other hand, we have witnessed significant growth in other DEXs driven by a wide range of DeFi initiatives (e.g. Curve and Uniswap). Since the start of 2019, Kyber volume has mostly remained range-bound between 15-20% of total DEX volumes. However, the growing popularity of long-standing venues and relatively new entrants in the last few months has meant Kyber’s DEX market share has dropped to just 4%.

To help explain why users might be using other venues other than Kyber we need context. Let’s take one of Kyber’s biggest competitor - Uniswap. It is well documented that Kyber typically requires ~5x more gas than Uniswap for contract executions. Combined with rising gas prices, contract execution costs has arguably made Kyber a less attractive trading venue when users have access to cheaper alternatives.

A proxy analysis was performed to determine whether the difference in gas costs would alter the adoption of Kyber and Uniswap (defined by trade count) when gas prices rise. A negative correlation between gas prices and adoption was observed - when gas prices started to rise at the start of April, Uniswap had a higher share of trades relative to Kyber.

KyberDAO

Shifting over to the KyberDAO, we can see that most of the KNC stake contributions are concentrated in the first week post-launch where 57m KNC were committed. However, contributions since have been very small with a total of 57.7m KNC now staked in the DAO today. Furthermore, exchange balance analysis shows that a further 31m KNC is held in centralised exchange addresses meaning an additional 100m KNC from the circulating supply is not being put to work in the DAO.

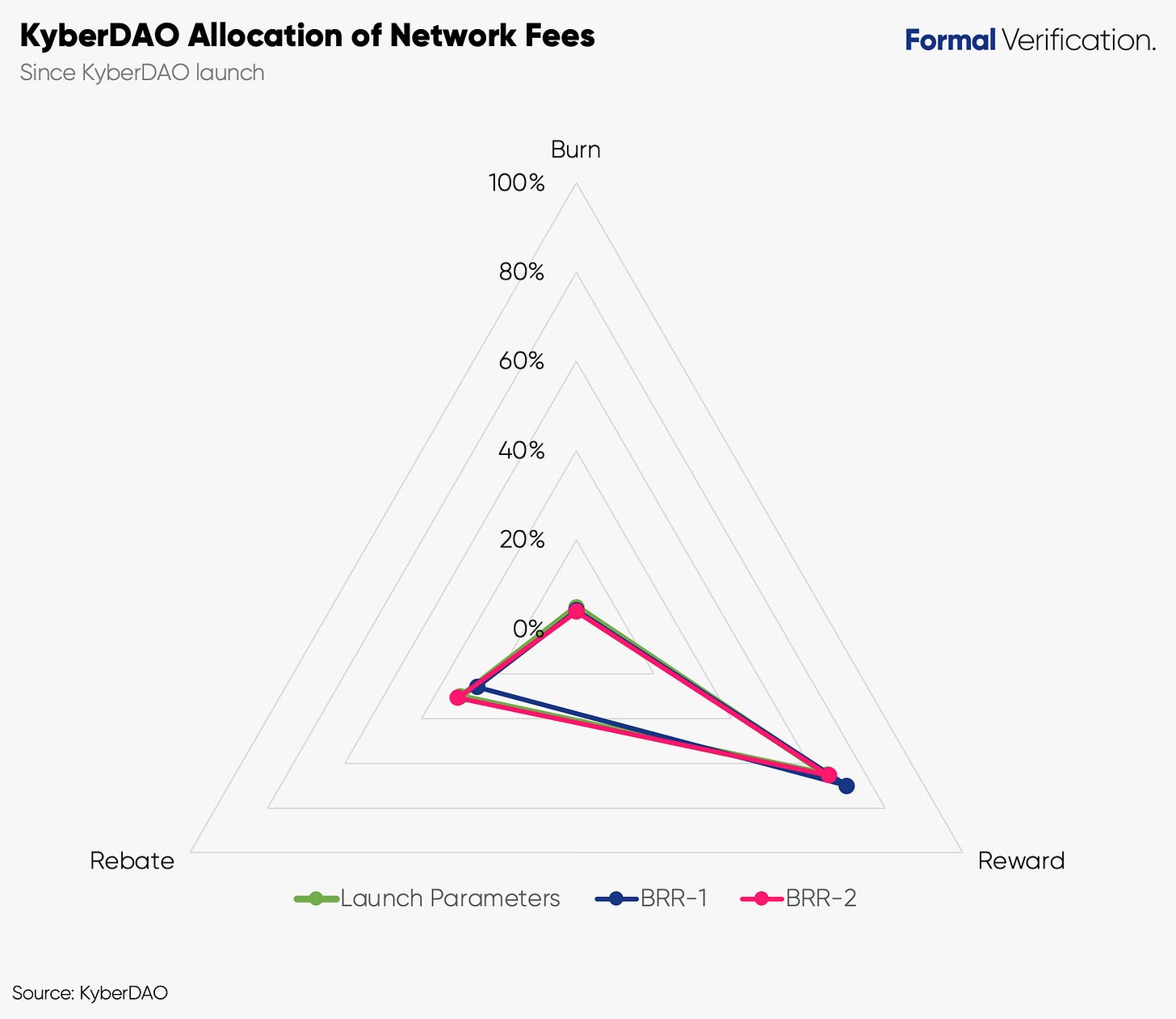

Kyber’s new Burn, Reward, Rebate (BRR) Proposal Framework requires stakers to be active in each Epoch in order for them to receive any voting rewards. As a refresher, each BRR proposals have 4 options (status quo, pro-burn, pro-reward, pro-rebate). A new preferred parameter will increase by 5% with the other two remaining parameters decreasing proportional to the original ratio between those two parameters.

Given that Kyber is only in its 3rd Epoch, there have only been 2 finalised BRR proposals. After a strong preference for the majority of fees to be distributed as voting rewards in the second Epoch, voting rewards were reduced in the third Epoch to allow for slightly higher Reserve Rebates (effectively reverting back to launch parameters).

With BBR-3 likely keeping the status quo, it is possible that the community are wanting to reduce the likelihood of liquidity exiting for liquidity mining programmes by boosting rebates to Reserves.

Although the KyberDAO continues to see recurring activity within each Epoch, there is evidence to suggest that rising gas prices have also deterred activity within the KyberDAO itself. For example, the number of addresses participating in the second vote decreased from 2.5k to 1.9k (with only 1.2k participating so far for the third and current vote). Additionally, the amount of KNC participating in the current BRR has fallen 50% from the second BRR.

Initially this seems beneficial for the stakers who do participate as they can claim a larger share of the pie. The problem is that claiming rewards also requires gas. For eligible stakers claiming rewards from the second Epoch, the reward on a per KNC basis was ~0.00001 ETH. Using the median transaction fee of 0.004 ETH on the day that claims could occur, stakers would have needed ~400+ KNC (~$700) staked to make the claim profitable.

So where does this leave us? Well, there are many variables that contribute to rewards and affect stakeholder decision-making that deserve close monitoring. Below is a non-exhaustive list of non-Kyber and Kyber specific factors that can each impact the net rewards distributed to KNC stakers (all else being equal).

Closing Remarks

As Kyber heads deeper into Katalyst, it seems there are two environmental challenges that the network has to overcome: one of an increasingly competitive DEX landscape and one of rising gas prices. These two challenges are important to consider because of their impact on the supply and demand side of the network, namely the LPs/stakers and traders.