In The Network - Decred

Correlations, Network Stakeholders, Treasury

This Formal Verification crypto research is free for everyone. If you don’t want to miss out on the latest crypto research and content, then hit that subscribe button today.

Decred

Decred was launched in February 2016 and aimed to improve on Bitcoin’s design elements. Some of the key distinguishing features are Decred’s hybrid PoW/PoS consensus algorithm and on-chain stakeholder governance. Although originally designed as an alternative P2P payments cryptocurrency, its multi-layer security architecture puts it in the category of a potential store-of-value asset making comparisons to BTC valuable. This is because Decred will prosper if it is able to realise money’s fundamental niche in ways that Bitcoin is unable to.

DCR and BTC

From June 2018 where DCR peaked at over $125, DCR has continued to demonstrate overall bearish action where it now sits at ~$14. What is particularly interesting to note is the relationship between DCR/USD and BTC/USD price over the years. Until the end of 2018, we can see the 1yr trailing correlation for DCR/USD and BTC/USD returns trending upwards to 0.8 - both assets were becoming increasingly correlated to one another suggesting Bitcoin’s increasing market influence over Decred. However, since then, the reverse was true as both pairs started to trade more independently to one another (note - the 12th March market wide crash naturally increased this correlation as assets fell and started to recover their losses). It remains to be seen whether Decred responds similarly to Bitcoin as a secure ‘hard money’ in the long-term against a backdrop of extreme monetary and fiscal policy responses to COVID-19 worldwide.

But correlations aside, and with such prolonged bearish price action, it is worth exploring the effects it has had on Decred’s network stakeholders that support the network - the miners, ticket stakers, and the community-governed treasury.

Decred Stakeholders

Decred’s consensus layer involves two types of participants so we will analyse the state of play for both proof-of-work (PoW) miners and proof-of-stake (PoS) stakers who collectively secure the network. We will also look at the state of the treasury which receives funding from the block reward and plays an invaluable role in shaping Decred’s adoption and use-cases.

PoW Miners

For those not familiar with Decred’s hybrid consensus model, miners compete to solve a hash function whereby the successful miner generates a block of valid transactions and propagates this block to the PoS layer (which we will discuss later). As a reward for their contribution to the network, miners receive 60% of the block reward (if approved by the PoS layer).

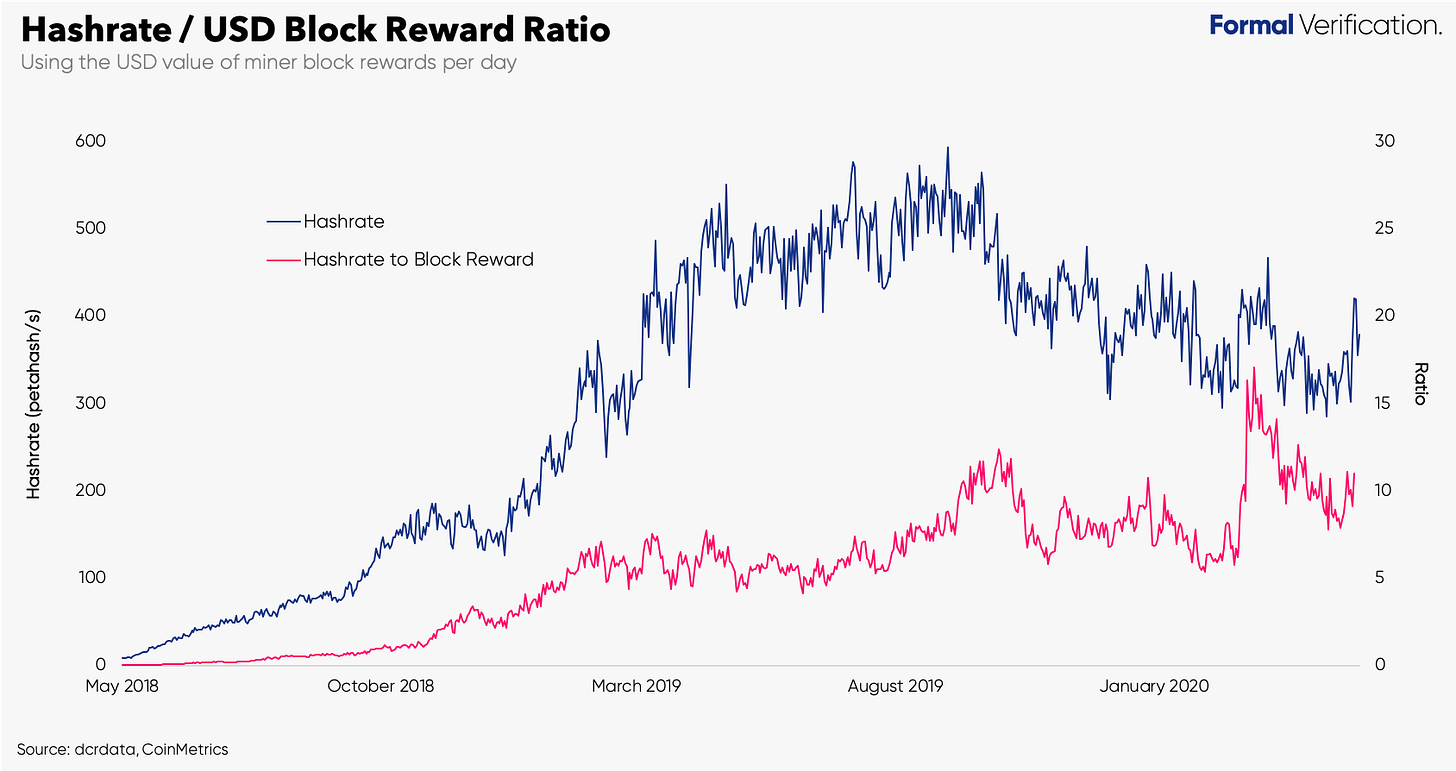

One obvious metric to look at is the simple hashrate output from miners securing the network. Hashrate peaked at 594 ph/s in September 2019 but has since dropped to 342 ph/s (a reduction of 42%). By assuming Decred miners have USD denominated costs, and by seeing the weak price action, it should not be surprising that miners (that were previously profitable) are no longer able to sustain their level of operations with sustained low USD denominated rewards.

Furthermore, we can analyse the ratio of hashrate contribution to the network and the USD block reward. This ratio allows us to see times when miners are contributing the most hashrate for the smallest USD denominated block reward and vice versa. In other words, when miners are at most risk of severe capitulation. For the first half of 2019, the hashrate to block reward ratio stayed relatively flat despite a consistent rise in miner hashrate. This is due to the mini DCR bull run during the same period which arguably offset this rise we saw in terms of miner investment. However, when DCR retraced back to $14 a few months later in October, the ratio broke out of its flatness and trended upwards as a greater amount of hashrate competed for smaller USD denominated rewards leading to inefficient miners reducing the hashrate.

Additionally, the March 12th crash meant the ratio naturally spiked (to an all time high) and inefficient miners were briefly competing for the smallest reward with the greatest combined hashrate. While recovery since the crash has helped moved the ratio down again, it still remains higher than pre-crash levels.

Another way we can determine periods of miner (un)profitability is the difficulty ribbon (SMAs of mining difficulty). As the most inefficient miners on a PoW network sell more coins to remain operational, they eventually capitulate leading to a reduction in hashing power and difficulty (where the ribbon compresses). What is noticeable is the severe capitulation that miners are facing as shown by the difficulty ribbon being flipped negative for some months. It is worth pointing out that it is unknown whether all of the weak miners have been shaken out at current price levels.

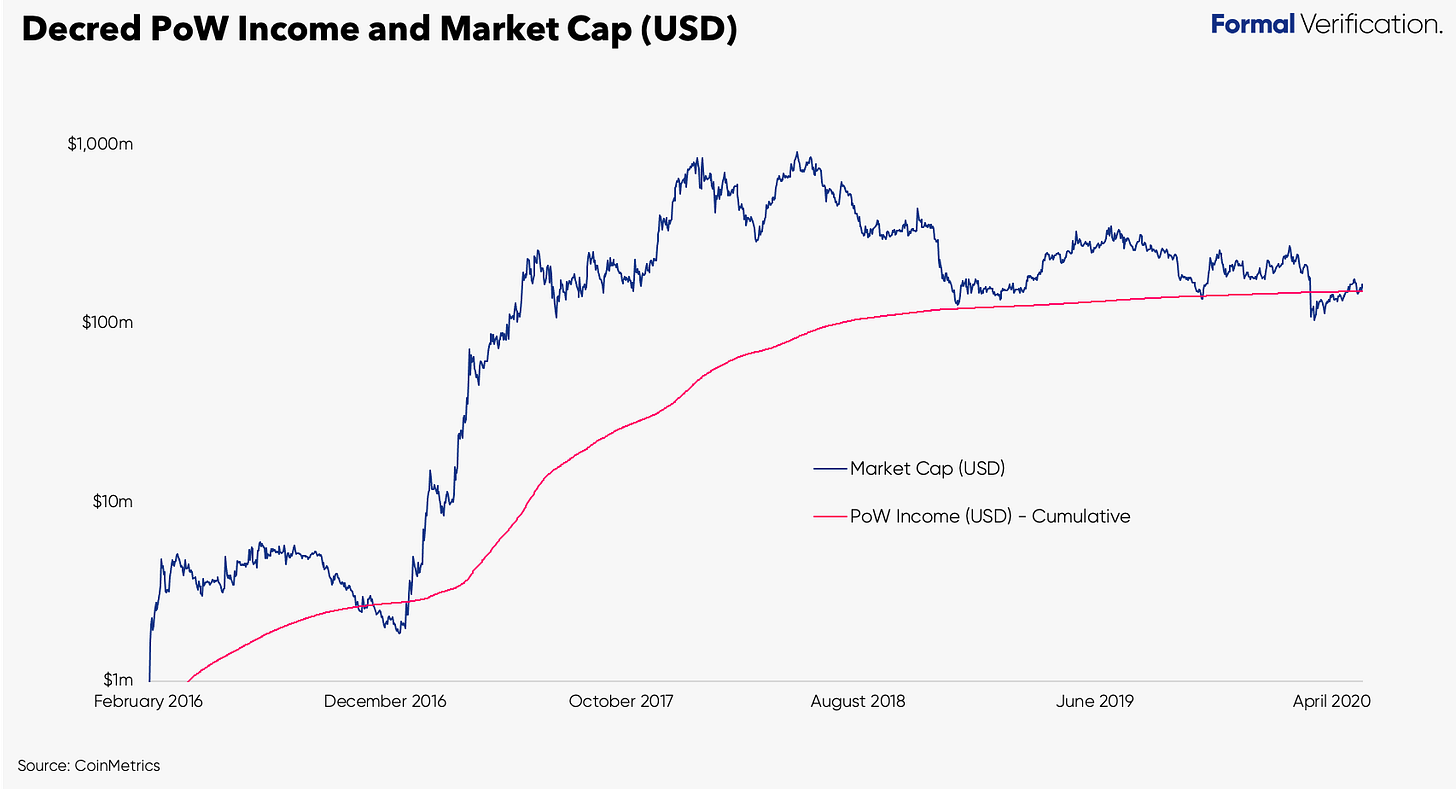

Instead of looking at difficulty and hashrate, we can also look at cumulative rewards paid out to miners since Decred’s launch. As mentioned previously, miners likely have a USD denominated cost and their mining cost (input) should not exceed the block reward (output).

To date, miners have received a total of $152m in mining rewards. Historically, the USD income for PoW stakeholders has acted as a fundamental support line during bearish market conditions. The March 12th crash took the market cap below this support line temporarily but has since moved back above it in recent days providing tentative evidence supporting this hypothesis (although more time is needed for it to prove itself).

The key takeaway here is Decred is trading at PoW issuance to-date. If we assume miners operate at near marginal costs, Decred is no longer trading at a premium to total miner USD input like we saw in 2017 and the first half of 2018. This also does not even factor in the resource costs by stakers who also play a crucial role in Decred’s consensus layer which we will cover next. Put differently, Decred is trading at a loss relative to total USD input to the network (PoW and PoS).

PoS Stakers

Now let’s focus on the other side of Decred’s security model - the ticket stakers. Here’s a quick refresh on Decred’s PoS: DCR holders stake to receive tickets from the ticket pool. Tickets have a DCR denominated but dynamic cost which is a function of supply and demand. For each block, 5 tickets are randomly selected from within the ticket pool and called on to validate the generated block by the miners. When 3 out of 5 tickets confirm the block, the selected tickets receive 30% of the total block reward in DCR. Additionally, any amendments to the Decred protocol or constitution require ticket holders to vote on-chain through Politea - a public proposal system used to allocate treasury funds.

Generally, as more DCR is staked in the pool, ticket prices will climb. Because locking DCR puts your assets in a temporary illiquid state, a growth in ticket staking signifies growing confidence in the network long-term (note - small DCR holders are not necessarily excluded from climbing ticket price due to the introduction of ticket splitting).

Overall, we can see that DCR locked in the ticket pool has consistently climbed over the years to reach a price of ~138 DCR ($1.9k) seen today. This increase in demand has naturally led to a corresponding increase in ticket price as well as the implied price (divide the total ticket pool value by the target ticket pool size of 40,960). Recently, growth in total value of DCR locked in the pool has reversed in recent months with 5.6m DCR (50% of circulating supply) now locked from 5.7m DCR seen in January. This could be an early sign of a stake participation ceiling, with few stakers willing to pay the recent high ticket prices.

Note, large deviations in ticket price from the implied price often coincides with large rebound movements (as seen throughout 2019) and might be used by some DCR holders to identify potentially oversold ticket prices in the short-term.

To further highlight the change in staking sentiment on the network, we can analyse the rate of net flows in the ticket pool over 28 days and 142 days. For context, 28 days is the average number of days for a ticket to vote and also fill up the ticket pool while 142 days represents the longest number of days a ticket can be valid before it expires. When plotted, we can see that net flows in the pool over 142 days bottoms ~400k DCR. However, since January this year, we can see that there has been a continued reduction in net inflow of DCR being added in the last 142 days which is currently stands at ~65k DCR.

We could also analyse the attractiveness of locking up DCR for a maximum of 142 days by looking at the ticket yield over time. Specifically, what is the reward for an individual ticket for each block over time? By using BTC as a cost basis for stakers, we can see that the reward per ticket on a BTC basis is at an all-time low (~0.0013 BTC). Furthermore, the yield for each ticket is now at 0.64% (yield per average staking lock-up period). Together this may, at least in part, why we are starting to see reduction in DCR locked up in the stake pool as holders potentially look to make their DCR liquid and trade back into other assets, such BTC.

Finally, unlike PoW, it is reasonable to suggest that ticket stakers evaluate their costs on a BTC basis because of investors hedging BTC profits into DCR and vice versa (see @permabullnino’s original post). To date, a total of 15.59k BTC has been paid out in PoS rewards. This coincides with Decred’s current BTC market cap which is at its lowest point in over 3 years. It is very much unknown whether current DCR holders will actively use this as a fundamental support line but the key takeaway here is DCR is trading at par with the total PoS (BTC) rewards paid to date.

Treasury

As mentioned previously, Decred aims to create an efficient governance structure that allows stakeholders of the network governance rights with how the protocol is developed. Some examples of work includes implementing lightning network and privacy feature with further research being proposed recently. One of the advantages of having a dedicated Decred treasury funded by block rewards is the consistent income of DCR over time as well as ensuring there is incentive alignment with contractors who might also choose to get paid in DCR on the other end.

The first thing to note is that the treasury has risen to a peak of 651k DCR in January 2020 but has since started to flatten out. Part of the reason is the increase in proposals for infrastructure, research, and marketing that have been seen submitted in the last two years. The other reason is due to the poor market price of DCR.

This brings us to the disadvantage of being funded by the native asset directly - the solvency of the treasury is effectively related to how DCR performs in the market - namely the DCR/USD pair. Remember - developer and community members often have costs in USD. With this in mind, we should expect a throttle in DCR denominated outflows during periods of weak DCR/USD periods in order achieve the same value in USD.

Once we factor in the DCR/USD price, we can see that although the treasury balance is still above 600k, the USD value has dropped 82% from a peak of $50.3 million mid-2018 to ~$8.94 million today. During this time, the average DCR outflows are also higher as contractors continue to be paid their contribution to the network. Therefore, having weak price action for the native assets works against you in 2 concurrent ways: the treasury USD value becomes weak, but the treasury also has to spend more on a DCR basis (and forgo potential future upside of this DCR) during this period of weakness. The treasury needs a re-bound.

We can also analyse treasury flows to see the rate of outflows compared to the rate of inflows on a USD basis. Despite market volatility during 2017 and 2018, cumulative USD outflows represented 10%-20% of the treasury inflows in USD terms. However, since that period we can see that the treasury outputs to inputs (USD) is now trending upwards with cumulative USD outflows now at 30% of cumulative USD inflows. Treasury costs are now outpacing treasury inflows. As you can see, this outpacing has been driven by a sharp reduction in DCR price since August 2018.

It is evidently clear that Decred’s treasury has been negatively impacted by the DCR market. Still, $9m might provide enough runway for stakeholders to weather out the storm in the short-term but without some re-bound or rally, the average rate of DCR debits on the balance sheet will outpace block reward issuance (which decreases 1% every 21 days). In the future, when the treasury becomes more decentralised in structure, network stakeholders may choose to participate in active treasury portfolio management in order to reduce single asset risk. We have seen other Layer 1 protocols like Tezos perform treasury management (and how effective it can be) although having a reliance on other cryptoassets might run counter to Decred’s social contract among the community.

Conclusions

As we’ve explored above, there is evidence to suggest that the continued bearish price action has started to have a negative impact on Decred's stakeholders in different ways and therefore puts potential future network growth at risk.

One of the hardest problems Decred has is competing with Bitcoin’s strong hard money social contract and network effect. Specifically, it is becoming increasingly uncertain what role Decred will play in a world where Bitcoin likely dominates the hard money niche/store of value niche. Unlike Bitcoin, holding DCR is an active process which raises the question as to whether there will be sufficient demand for DCR in the long-term to support Decred’s security model over Bitcoin’s.

We are starting to see weakening demand for DCR more generally and, if this continues, Decred stakeholders may start moving away from the network if the rewards don’t start meeting the respective resource contribution.

About Formal Verification

In collaboration with leading digital assets data companies, Formal Verification offers both key and concise data analysis and ecosystem research for decentralised networks so you can be attuned to the absolute key crypto developments both on and off the chain.

Formal Verification will be free for everyone until June 8th. If you subscribe before June 8th, you’ll receive Formal Verification at a 20% discount forever as a special thank you for your early support. Get it locked in.

Formal Verification research is not investment advice and is strictly for informational purposes only. Conduct your own research.