In The Network - 0x

Adoption, Stake Pools, Niches

This Formal Verification research is free for everyone. Join the other Formal Verification members today and get full access to complete research and member-only bonus content.

0x

0x is a permissionless protocol built on Ethereum that enables peer-to-peer exchange of assets. In April 2019, a stake-based liquidity incentive proposal was created (ZEIP-31) which marked the start of a significant change in how the protocol would operate by rewarding key 0x stakeholders that contributed resources to the 0x network.

In short, market takers pay a small protocol fee (150,000 * gasPrice * orders filled) for every trade that occurs on the new version of the 0x protocol (V3) which are collected in a fee pool. Market makers (MMs) receive liquidity rewards proportional to the protocol fees generated from order facilitated by them as well as their ZRX stake. MMs can also be delegated ZRX if they do not hold sufficient ZRX themselves (and set a fee sharing percentage).

State of The 0x Network

Exchange volume on 0x occurs on essentially 2 protocols (V2 and V3) in parallel. It is at the complete discretion of market makers, relayers, and applications to choose which protocol to use. Overall, combined V2 and V3 volume has been respectable throughout 2020, climbing to new ATHs eventually reaching $133 million in March. In USD terms, V3 volume has made up ~20% of the combined 0x volume in USD, marking a decline from its peak in February where it had a 47% share.

Isolating activity from V3, we can see that volume declined for the month of April and May reaching just $34 million and $24 million respectively. What’s critical here is that protocol fees only apply to V3 orders. Trends in fees largely correspond to V3 trading volume (note epochs can carry over fees from previous month). Total protocol fees taken since the launch of V3 have only amounted to ~$73k with the largest amount of fees taken in a single month being March (~$20k).

Volume has also been small for more niche markets. Assets from once hyped Gods Unchained has only attracted $130k in trading volume but, with continued decline for several months, assets from the game are now trading at ~$1.5k (and ~200 trades) daily.

As explained briefly, if protocol fees are only applicable to V3 orders, there is a natural concern to ZRX delegators that relayers, market makers, and applications don’t migrate over to the new V3 contracts. With this in mind, these type of 0x stakeholders should continuously analyse V3’s protocol adoption to identify how much activity is being captured by V3’s new set of incentive mechanisms.

Besides volume, the number of trades across both protocol versions are also different. The number of trades for V3 increased relative to the number of trades seen for V2 in the months of February and March (reaching 40%) but has since declined to only ~30%, largely keeping in line with the relationship between both protocols for volume. Additionally, volume on V2 is also increasing at a faster rate than its trade count which is increasing the average trade size in USD at a faster rate than seen in V3.

One of the new additions to V3 is the integration of 0x API which allows applications to pull liquidity from several sources (e.g. 0x Mesh, Uniswap, Kyber). All ‘bridge’ trades that funnel through the 0x API still pay protocol fees. Digging deeper into the relayer distribution since the launch of V3, we can determine that the 0x API was responsible in sourcing most of the volume during the volatile period in March (67% at its peak).

While this is essentially good for MMs and ZRX delegators, we have started seeing the rise of DEX aggregators. For example, DEX aggregator 1inch has just surpassed $500 million in total volume. The risk here is that, instead of having a protocol fee applied for every bridge trade facilitated by the 0x API, applications might alternatively opt to plug into APIs from alternative providers like 1inch - seeking the lowest slippage and best price while only paying fees where they are necessary. If protocol fees for 0x API are considered the premium, what is the added value?

ZRX Staking

There are more than 17.3 million (~$6 million) ZRX staked which only represents 1.7% of the total ZRX supply. Notice in early May that 1.6 million ZRX was unstaked over a 4 day period during the multi-day ZRX market rally from $0.20 to $0.43 illustrating certain opportunistic behaviour by stakers.

Critically, rewards for MMs is dictated by a Cobb-Douglas function where rewards is based on both the amount of fees generated and size of the MM’s stake relative to its peers. What’s important to consider in the function is a constant in the function (α) in the range of 0-1 that determines the weight of fees vs stake. When α = 0, liquidity rewards is solely based on liquidity contribution. With α = 1, liquidity rewards is solely based on staking contribution.

Initial parameter suggestions in 2019 set α at 0.5 giving equal weighting to both liquidity and stake contributions in calculating rewards. However, before the launch of V3, α was revised to 0.75, meaning there is currently a greater incentive to contribute liquidity and a lower incentive to stake ZRX.

By looking at the aggregated total rewards across the 8 staking pools, there have been a total of 570 ETH has been paid in protocol fees to MMs with a large portion of this of course coming from the highly volatile mid-March period. In line with declines in volume, rewards have suffered since March with epoch rewards averaging just 21 ETH in May. What’s noticeable is how small the portion of rewards are shared to ZRX delegators (historically the average share percentage is 12%).

Zooming out, the liquidity rewards are low relative to other fees taken from DEXs through their respective models (e.g. Uniswap and Kyber far exceeding total fees taken over the same period). Analysts often simply look at total DEX volume for token valuation purposes as well as for comparative DEX analysis without considering certain nuances. For example, in the case of 0x, particular network stakeholders (e.g. ZRX delegators) might only be concerned with comparing V3 volume figures. This is because protocol fees taken on V3 orders ultimately underpin the value flow to passive ZRX stakers (relay fees also apply here but relayers are the complete benefactors).

When we isolate V3 volume and compare this to other DEX projects, 0x only has 1.7% of total DEX Volume for June so far (note that liquidity can be shared across projects in some cases which can affect numbers here). Therefore, ZRX holders should be concerned not only with V3 volume growth itself but also how much market share V3 has with other projects.

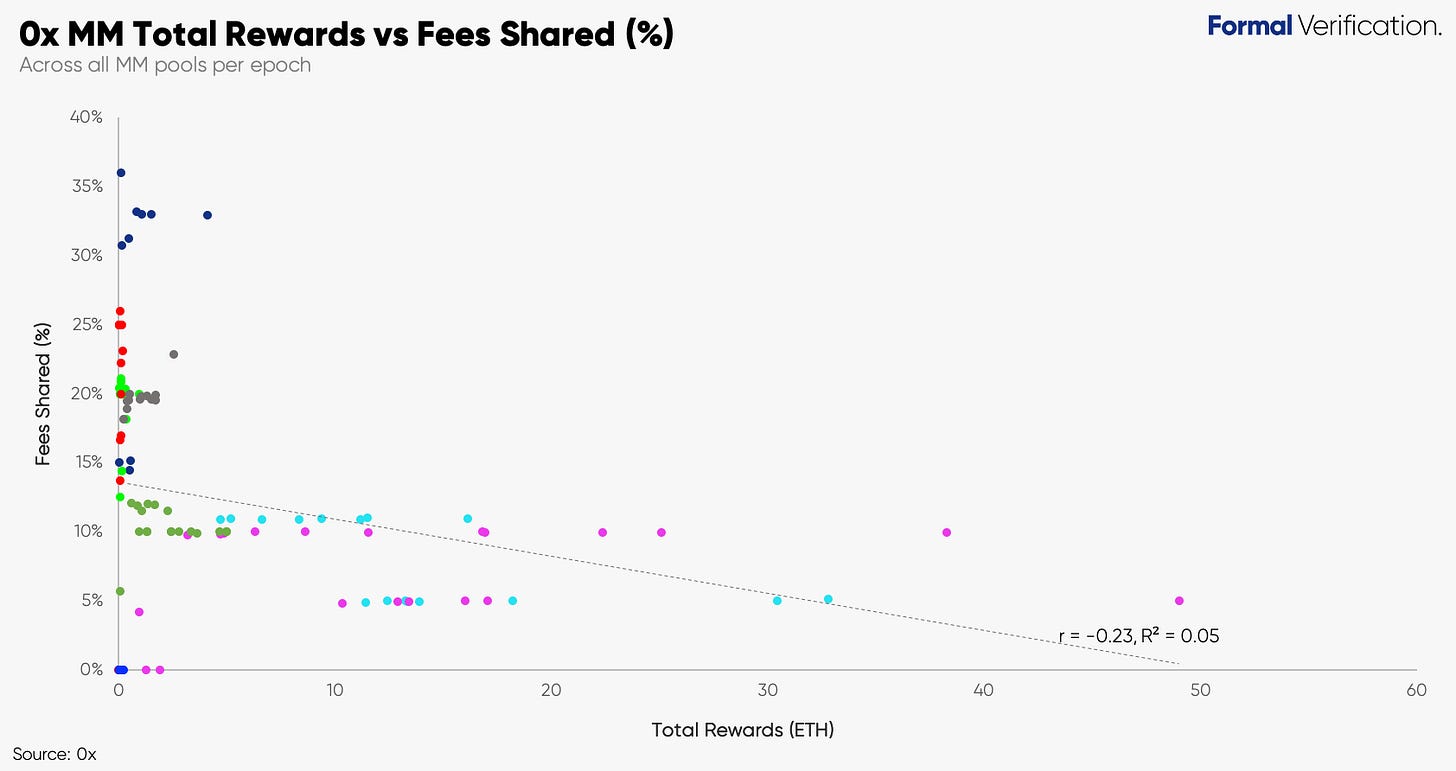

MMs are the 0x stakeholders that get to decide how much of their fees they share with stakers that delegate to them. Delegated ZRX also only has a 90% weight. Due to their highly valuable contributions, MMs are clearly put first in the system. A strategy for an MM might be to give themselves greater reward when liquidity rewards funnelled to them is higher particularly when rewards per unit of ZRX staked are maximised (stake oversaturation). Therefore, we should also look at the relationship between total rewards and fees shared across the available V3 stake pools.

The first thing to note is the wide range of fees shared across the pools recorded for each epoch (range between 0% to 36%). Overall, when total rewards are very low, fees shared to stakers are higher and vice versa. This is somewhat to be expected if we consider newly created stake pools encourage ZRX stakers to re-stake to when rewards per unit of ZRX staked are not initially maximised (as dictated by the Cobb-Douglas alpha function). However, looking at individual pools (separated by colour), there is some early evidence that point to selfish MM behaviour - fees start to lower as rewards increase for MMs as can be seen with Prycto (light blue) and DUST (purple).

While this is only using a limited time frame, it nonetheless highlights a risk to ZRX delegators particularly when pools they are staked become increasingly oversaturated - MMs can afford to increase their own rewards when oversaturated in ZRX stake. The problem is exacerbated when stakers have limited options in finding stake pools that are in need of optimising for rewards. This is currently the case with most pools being oversaturated by at least 200%.

As ZRX can be classified as a crypto capital asset, we can also evaluate flows relative to its market price. If we plot annualised earnings change against ZRX price change since the start of 2020, we notice an interesting relationship - there is a weak to moderate negative correlation between annualised earnings change (r = -0.39, R² = 0.15). Note the coefficient of determination is very low here.

Importantly, crypto capital assets do not all exhibit this relationship (for example, Kyber exhibits a moderate positive association between the two variables). The relationship we see here requires some context: There was strong positive ZRX price when ZEIP-77 passed enabling epochs durations (and thus distribution of rewards) to be reduced from 10 days to 7. Ironically, this spoke to very little about the underlying value flows themselves and as highlighted above, trading volume on the V3 protocol was actually declining.

Conclusions

Isolating activity on the V3 protocol highlights how far 0x has to go in terms of both inward adoption (migration of existing stakeholders) and external adoption (DEX market share) which is being reflected through the low liquidity rewards for MMs and delegators. At present, MMs have significant leverage over delegators in the system and with most pools oversaturated in stake, there is little incentive for prospective delegators to contribute further to the network.

One of the potential avenues that 0x should explore is dominating an entirely new niche. More positively, there are signs that the 0x team have identified just that with the team very recently announcing the foundation of 0x Labs which will aim to establish unexplored markets as well as build out more novel trading experiences for end users.

About Formal Verification

Institutional-grade digital asset research

Formal Verification offers both key and concise data analysis and ecosystem research for decentralised networks and digital assets so you can be attuned to the absolute key developments both on and off the chain.

Formal Verification research is not investment advice and is strictly for informational purposes only. Please conduct your own research.