Deep Dive - NecDAO

One of the largest DAOs you've likely never heard of

This Formal Verification issue is free for everyone. If you don’t want to miss out on the latest research on digital assets and decentralised networks then hit that subscribe button today.

NecDAO

DeversiFi, a non-custodial decentralised exchange on Ethereum that utilises StarkWare’s zk-STARKS as a layer 2 scalability solution, is set to launch today. For those unaware, DeversiFi is effectively a rebrand of the Ethfinex exchange which closed its doors in August 2019. The exchange itself will be directed by the relatively new necDAO along with its respective Nectar token holders - both of which will be the main focus of this research.

For some context, Ethfinex first developed the Nectar token (NEC) some time ago. It was originally designed to be a loyalty mechanism whereby market makers were pledged 50% of the combined trading fees on the exchange. At the time of the Ethfinex to DeversiFi transition, the remaining ‘fee pot’ stood at ~17k ETH. Beyond being a loyalty programme, NEC also allowed holders to participate in an experimental governance playground. For example, traders were able to decide what tokens they would like listed allowed by the Kleros dispute resolution court.

Now, Nectar has moved from being an inflationary to a pure deflationary model by implementing several mechanisms which will be touched on later. To mark this shift in DeversiFi’s approach, the team burned 400m Nectar tokens (~$20m at the time and 40% of total supply) in March this year. Critically, these tokens were owned by Ethfinex but it was an attempt to give NEC holders a higher stake in the DeverisFi exchange.

Incentivising Growth and Utility

The newly formed NecDAO, powered by DAOstack, will be funded by the remaining collected fees meaning 17k ETH can be funnelled into the necDAO (making it one of the largest DAOs to date). Any NEC holder can choose to stake NEC into necDAO to earn reputation. Any holder with reputation is able to submit and vote on proposals which may include proposals that debit the necDAO ETH balance.

However, beyond giving stakers the ability to gain reputation in the NecDAO, holding Nectar tokens gives traders the right for fee discounts (up to 0.2% fees on DeversiFi) and fees are discounted on a rolling basis. Based on the parameters shown below, if a token holder has 10k NEC (average balance in address over past 30 days) they will be given a 15% discount on their first $1 million trading volume in a 30-day period.

Clearly the structure in place to incentivise higher trading volume and larger order sizes. Discounts are applied commutitavely with the absolute max discount traders can receive is 53%.

Tying this altogether, NEC holders are able to capitalise on fee discounts as well as participate in the DAO overseeing the exchange. The hope here is to provide an overall model that amplifies network effects around DeversiFi’s liquidity through incentive alignment.

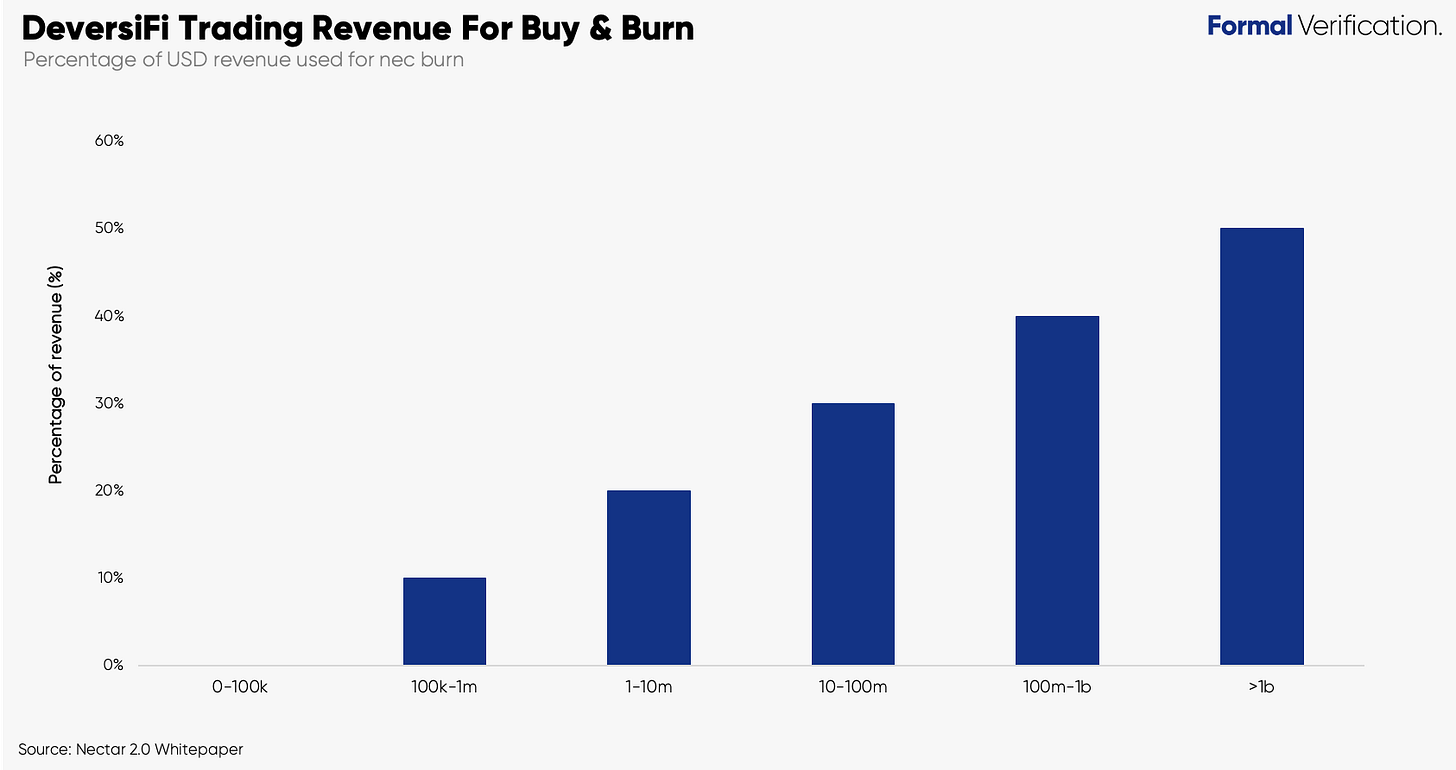

But what incentives are in place for Nectar holders specifically to grow the activity on DeversiFi as a whole? This is where the DeversiFi’s buy and burn mode comes in. One of the major driving forces in the reduction of NEC supply will come from the DeversiFi team who intend to use a percentage of their trading revenues (up to 50%) to buy back supply through a daily auction system, called ‘necBurn’.

This is the theory - if there is higher volume of trading that leads to a greater reduction of NEC supply, daily buy and burn auctions will provide ongoing buy-side pressure in NEC markets. A benefit of using auctions is that the NEC purchasing cannot be front-run but it remains to be seen how effective these auctions will be in the long-term. Furthermore, it is unclear how much heavy discounts (but with high associated volume) will counter the revenue contributions used for buy backs.

An important point to note is that all NEC tokens were frozen at the start of the NEC 2.0 transition and only until a holder participates in either staking or claiming during the redeeming phase can the tokens be transferable between addresses. Users can also burn their NEC instead to receive their proportional share of the fee pool.

Over time, NEC will represent the inverse to the recent SAFG model that we’ve seen (e.g. Compound and Futureswap). Instead of rewarding users a non-transferable governance token for their contributions of time and resource to a protocol, the necDAO is completely open to whoever is willing to participate. Critically, while reputation can somewhat be earned over time through submitting successful proposals, NEC tokens will be available on the open market and the model simply incentivises purchasing a greater amount of NEC to accrue a greater level reputation for the respective user.

A potential problem here is that the necDAO is not governed first and foremost with the active users of the exchange. Governance members are forced to buy and lock NEC - members might decide to stake in hope for a return (by wanting to reduce circulating supply) without any desire to contribute to the development DeversiFi. Overall this might prove to be a sub-optimal framework for governance.

State of the DAO

Let’s dig into some numbers. While only launching on the 24th January, necDAO only has 108 members. Interestingly, a total of 359 addresses have a NEC balance meaning only a third of holders are members. The number of NEC staked in the DAO is ~75m which equates to 25% of the circulating supply.

Looking at the the governance specific metrics, there have been a total of 19 proposals, 47% of which have been successful. Although votes seem to be growing on a month-by-month basis, voter turnout is low at just 32%. Proposal participation (where reputation can be further earned in successful cases) is even lower at 12%.

In terms of ETH funding, 17k ETH is to be dripped into the DAO over time. Currently, if the balance runs low, a request to Bitfinex is required to withdraw further balance. After the launch, a vesting contract will be created that will vest remaining funds over a 3 year period (to avoid a DAO honeypot). To date, the DAO has received a total of 800 ETH to date. There is currently 599 ETH in the DAO (~$143k) - a large portion of these funds (196 ETH) was deployed due to an approved marketing proposal by the DeversiFi team in hope to bolster trading volume long-term therefore benefiting NEC holders.

Closing Remarks

DeversiFi is the latest contender to enter the increasingly crowded DEX space. But the launch of DeversiFi is intriguing. There are two experimental fronts here: the necDAO oversight as well as the StarkEx engine that will ultimately power the exchange behind the scenes. DeversiFi’s target users will likely be day traders who may be seeking new speeds capabilities in DeFi without sacrificing on security - all thanks to StarkWare’s validity proofs!

As often is the case, liquidity is key here. DeversiFi will initially have the benefit of pulling in Bitfinex’s liquidity to help bootstrap initial growth but frequent high volume is paramount for its long-term success and, importantly, to test the thesis on NEC’s value accrual mechanisms.

About Formal Verification

Formal Verification offers both key and concise data analysis and ecosystem research for decentralised networks and digital assets so you can be attuned to the absolute key developments both on and off the chain.

All Formal Verification research will be free for everyone until June 8th. If you subscribe before June 8th, you’ll continue to receive all research at a 20% discount forever as a special thank you for your early support. Free members will only get occasional research posts. Get it locked in.